AI engine responding to recent market movements

March 2025

by Frank Siu

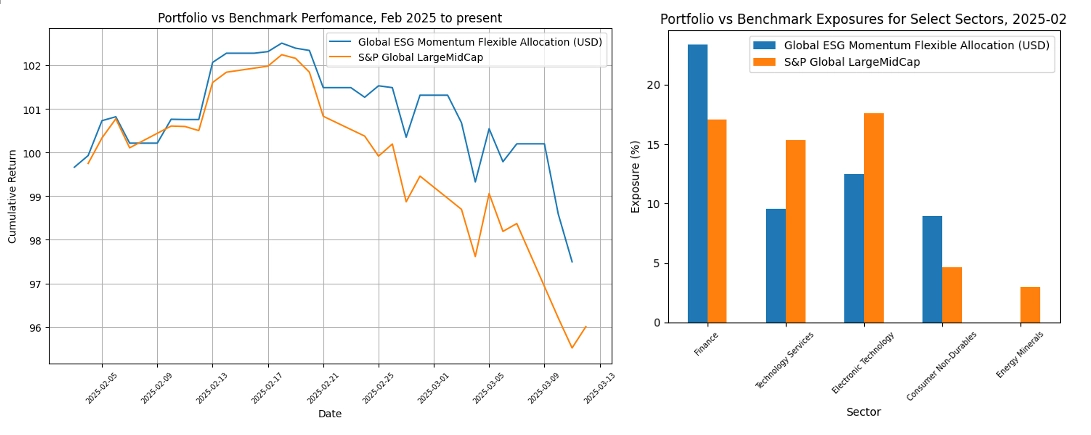

Global equity markets have been heading downward in light of concerns over a US-led trade war and other policy uncertainties. Starting in mid February the Arabesque AI engine sharply pivoted towards favouring Financials, Real Estate, Utilities, and Consumer names, and underweighting Technology.

All the Arabesque funds leverage our proprietary AI forecasting engine which produces daily stock-level predictions of price movements, ingesting tens of billions of data points into an extensive pipeline of both supervised and unsupervised machine learning model architectures to learn and capture the complex relationships between companies' financial characteristics, prevailing macro conditions, and the effect on security prices.

Source: Arabesque, Factset, S&P

The AI engine was able to recognize the increased market turbulence and correctly identify the sectors and defensive characteristics that were likely to outperform in such a potential "risk-off" market climate. All of these sector bets turned out to contribute positively to strong fund performance from February to present day. Indeed those were precisely the sectors and market segments that outperformed broad indexes during this period of market uncertainty. MSCI ACWI Financials outperformed ACWI by over 2% last month, and ACWI Technology underperformed by almost 1.5%. ACWI Consumer Staples outperformed by almost 5%.

This favourable sector positioning is very clear in all our funds. In the case of the Islamic funds where Financials are absent, the underweighting of Technology and overweighting of Consumer names nonetheless impacted performance positively. This "flight to quality" phenomenon can also be seen in some of the AI's country positioning recently, choosing to increase exposure to traditional safe-haven countries like Switzerland, and this too has benefitted performance.

Additionally the flexible allocation funds, which began February with around 10% cash, clearly responded to the increased in uncertainty by gradually increasing its cash position through the month to ~17% cash currently.